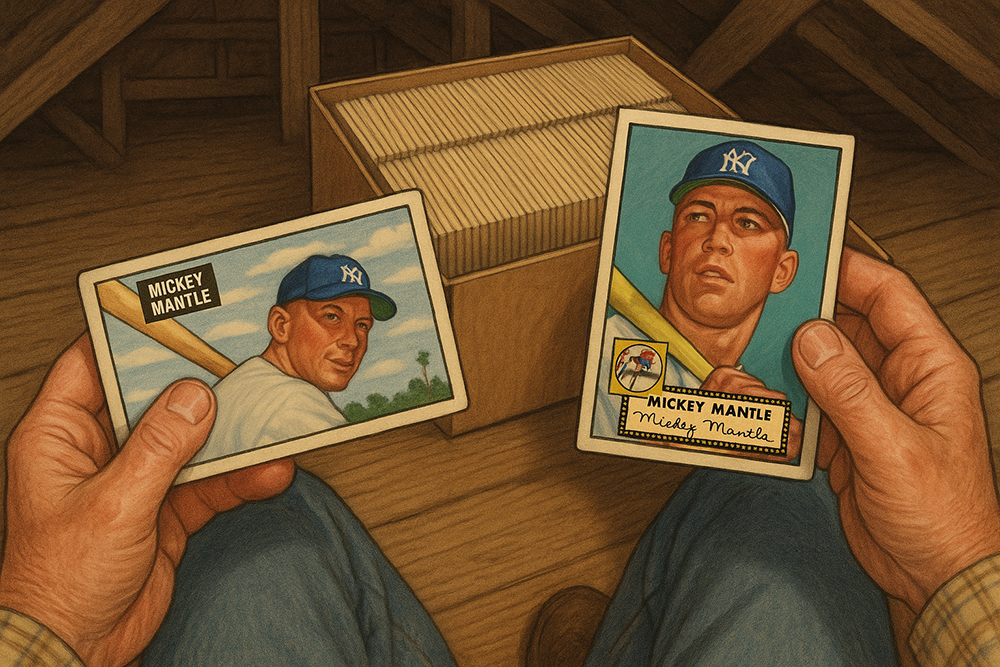

People’s genuine interest in a collectible is always a better indicator of what’s worth the price tag and what isn’t.

Promising returns in the first few weeks of the new year have NFT watchers hoping for a comeback. But with demand from its 2021 peak largely evaporated, collectors wondering if they should get in on the NFT trend would do well to remember a key buying principle: Collectors are led astray when driven by speculation. Stick with what you love.

NFTs (or non-fungible tokens) exploded onto the scene in 2021, in a moment where internet investors began flexing their buying power in new ways. The crypto market was reaching new highs, while meme stock traders temporarily broke Wall Street with their short squeeze tactics. NFTs were both a side effect and a symptom of the time, wherein internet buzz was enough to generate significant demand.

With collections like the Bored Ape Yacht Club and Crypto Punks, demand for NFTs suddenly skyrocketed. Art connoisseurs were pushed to believe that these digital files represented the next generation of art collecting, as their provenance could always be verified, and their presence on the blockchain meant they could never be destroyed.

A lot of encouragement to get involved

Sports collectors, for their part, were also encouraged to get involved, as sports-governing bodies including FIFA, the NBA and the NFL, all came out with their own lines of NFTs. NBA’s TopShot offered fans the ability to purchase what amounted to digital trading cards that featured key games and moments — including one Lebron James dunk that auctioned for $400,000. The leagues’ biggest superstars encouraged fans to get in on the newest frontier of sports memorabilia collectibles.

But by January of the next year, the value of NFTs had largely collapsed with demand going out the window, as the crypto winter turned investors off to digital assets. Up to 95% of NFT collections today are worthless.

For collectors, the NFT madness offers an important reminder: If you don’t understand it, don’t buy it. Your genuine interest in a collectible is far more indicative of its true value than market trends.

It’s a straightforward concept, but one that’s often forgotten about in these sorts of hype-driven bubbles. It’s the rare bubble that features an asset that’s virtually intrinsically worthless. But this one did. The value of NFTs was almost entirely arbitrary and highly dependent on the greater fool theory. When the market ran cold and the likelihood of the fools appearing waned, the market collapsed.

NFTs’ rarity felt uncertain

For any collectible item at auction, value is based on a handful of factors that include the rarity of the item, its provenance, its intrinsic value, its condition and market trends. The issue that NFTs faced (and continue to face) is that their rarity felt uncertain, and there was no intrinsic value. (The NFT of an NBA game moment did not give the owner the right to license the photograph, for instance.)

Certainly, NBA TopShot can tell you that there are only a certain number of NFTs issued of Chet Holmgren’s first dunk, but how that NFT is valued compared to the widely available — and free — video on YouTube of the same event remains unclear.

There’s no guarantee that more versions of the same item couldn’t be minted in the future. NFTs are easy enough to create; the internet is full of videos and tutorials on how both artists and enthusiasts can create their own NFT collections. Even the most lucrative NFT collections, like the Bored Ape Yacht Club, aren’t Picasso-level works, but simply copy-and-paste digital prints.

The prices of Bored Ape Yacht Club NFTs were largely driven by the social status with which they imbued the owner. That Justin Bieber and Neymar were fellow owners, it seems, was a major part of what drove demand (and prices) up further.

But social status fades, and individuals who invested because of FOMO (fear of missing out), no doubt overpaid dramatically — as is always the danger for collectors who follow trends rather than interest.

An asset class that can’t be relied on

People’s genuine love and interest — whether in NFTs, sports memorabilia, cars or art — is always a better indicator of what’s worth the price tag and what isn’t. Because of the changing value of collectibles, it’s an asset class that can never wholly be relied on as a sure thing, which is why it’s better to make sure that you actually enjoy the picture of a monkey wearing sunglasses before spending thousands of dollars on it.

Certainly, there are individuals who have genuine interest in NFTs, and they are the collectors for whom they will retain some measure of value. And because NFTs are in essence a certificate of authenticity for a digital asset, their provenance should be quite precise — a fact that also may carry some value for engaged collectors.

If you’re looking to invest in NFTs because you’re hoping to sell high, you may want to rethink your strategy. Bill Gates also noted that NFTs were “100% based on greater fool theory,” and after their significant collapse, it’s unlikely that the masses will want to be taken for the fool again.

But if a digital poster of Shakira is genuinely what’s of interest to you, it may very well have value to similarly minded collectors in a few years’ time.

Hype and mania can be enticing times for collectors, but remaining true to their own interests is essential.

— Thomas Ruggie, ChFC®, CFP® is the founder and CEO of Destiny Wealth Partners. Follow him on Twitter and LinkedIn.