Sports memorabilia, already a solid alternative investment, stands to become a hotter investment ticket with the creation of a bound-to-be-popular marketplace, but could it overheat?

When approaching the sports collectibles market as a potential investment strategy, it is imperative to enter with eyes wide open and invest only what you can afford to lose. It can be risky, valuations can fluctuate substantially, and the timing of any purchase or sale will ultimately determine long-term success.

Sports memorabilia has been changing hands for more than a century, and recent events suggest that values may get a boost as a more efficient and liquid market for collectibles emerges. The latest evidence: Fanatics, the multibillion-dollar ecommerce platform focused on sports team merchandise, plans to launch a collectibles events business next year.

Fanatics Events seeks to create the Comic-Con equivalent for sports, which means current and former player appearances, panels and a vibrant marketplace. The company is capitalizing on the growing popularity of collectibles and will partner with entertainment giant Endeavor’s IMG unit on the event series.

Collectibles can be good alternative investments

Quality sports collectibles have long been a solid alternative investment, and the creation of an accessible, high-visibility marketplace is bound to spur further momentum. Any market that has heated up significantly, of course, runs the risk of overheating.

Have we reached that moment? Probably not.

Collectibles markets of all stripes — from cars to watches to NFTs — got a lift during the pandemic. People stuck at home took more of an interest in collecting, quickly shifting the hobby to a business opportunity. And big money always chases opportunity.

The market for sports collectibles has begun to show signs of increasing orderliness. We see a tiered list of players that includes legends, potential future legends and stars.

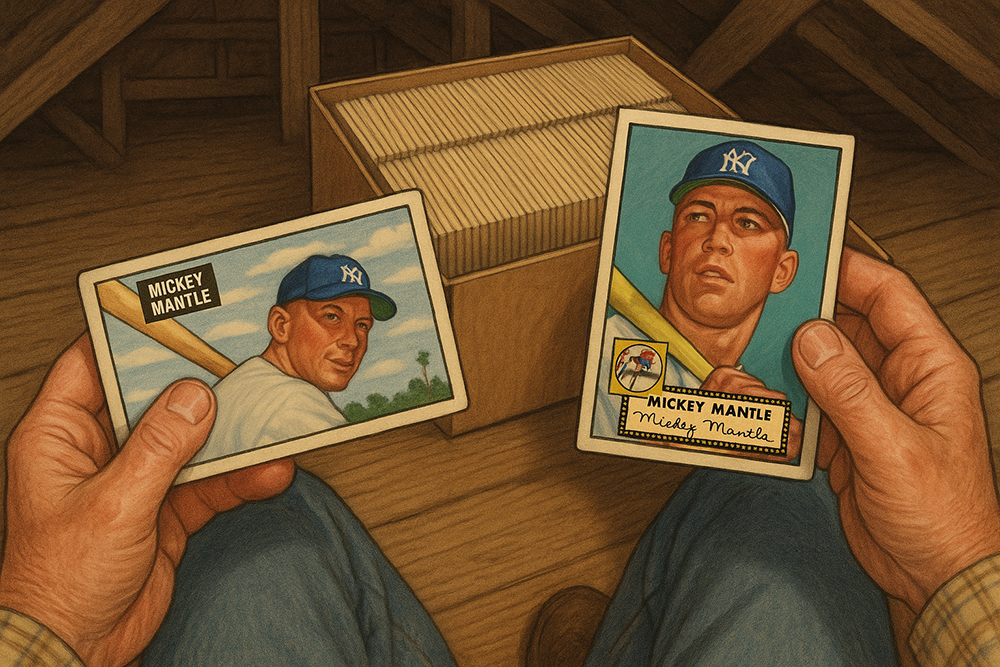

The top names, true legends of their sport, such as baseball Hall of Famers Babe Ruth and Mickey Mantle, are blue chips. Those players’ memorabilia, owing to their vintage and exclusivity, are likely going to rise in value over time.

Memorabilia of current sports stars with proven records, like NBA players LeBron James or Steph Curry, fall a level below that of Ruth and Mantle. These players’ careers are in full bloom, and prices have been pushed up high as a result. Because of the long-term nature of their performances, however, their legacies are assured, and they almost certainly will become blue chips one day.

Upside potential but with some risks

Items associated with star players who are not among the top echelon for extended periods of time have upside potential but may be a riskier bet — like smaller technology stocks. This is because some may emerge as the best to play the game, while most will fade too quickly to be considered true legends.

Older cards carry a scarcity value — only so many were printed at the time. It’s harder to predict what may happen with newer players. Popular outfielder Aaron Judge, for example, has a good, yet short, record, and he plays for the Yankees in New York, a media hotspot. The question is, can he maintain his fame and extend his performance record? Products tied to him have upward price momentum now, but the trajectory for the future is less understood.

The sports memorabilia market has a different dimension, too. Unlike stocks, collectibles have an abstract value driven by a passionate base — much like fine art.

As Fanatics develops its events business, opportunistic buyers may enter the market, unsure of how to value collectibles. Witness the collapse of the market for NFTs, which had been wildly overvalued.

A step forward, thanks to events like these

Fanatics Events is likely to have a big impact on the market, as a bigger marketplace offers potentially higher transaction volumes and more transparency. One significant risk of the market has been liquidity, and while these events alone won’t obviate that, they inevitably mark a step forward.

Sports collectibles can be an excellent component of an asset portfolio — but probably not a major one. A hobbyist who enjoys the pastime of collecting and sees value in owning sports memorabilia might want about 10% of their portfolio in collectibles. That’s a reasonable risk to take.

It’s also wise to keep a collectibles portfolio that’s weighted toward blue-chip stars. Full disclosure: I own a pair of Muhammad Ali fight-worn trunks. I have a passion for boxing, and I think it’s a very good bet that his status as an American icon will continue to drive their value.