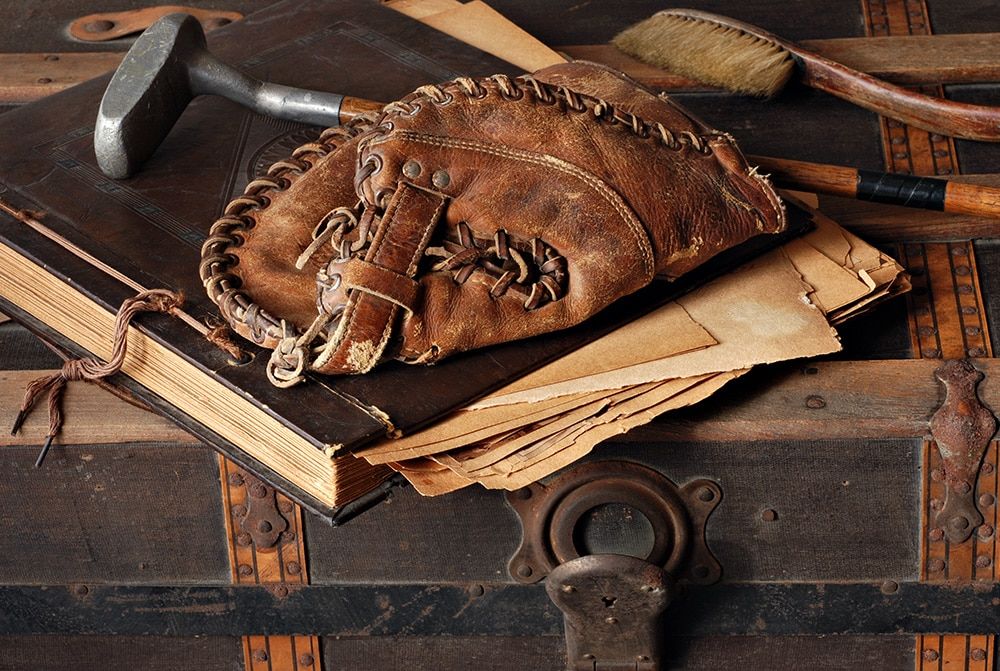

Thomas Ruggie is the proud owner of the boxing trunks Muhammad Ali wore to fight George Foreman in the famous 1974 Rumble in the Jungle match. The shorts take pride of place in his collection of sports memorabilia.

Ruggie, a Tavares, Florida-based planner, also has plenty of clients who collect — everything from wine to art to exotic cars.

“The people I’m dealing with have collectibles worth between 10% and 20% of their net worth,” he said.

Some clients amass standard collectibles; others invest in cultural artifacts like those boxing trunks (which Tavares estimates are worth in the low to middle six figures).

No matter what they collect, clients need guidance. That can include advice about the investment qualities of their collections, best ways to protect investments and help making succession plans.

Are collectibles also investments?

The collectibles industry is gradually making collections more reliable as investments, said Joe Orlando, vice president of Chicago-based Heritage Auctions. Growing interest in preserving provenance, better access to information about collectibles’ condition and worth and more third-party authentication and grading services have given customers much more confidence in what they’re buying.

“You used to have to just trust the seller,” said Orlando.

Prices have gone up hugely in the past two decades, though the percentages vary across the universe of collectibles.

“Some percentage of collectors in recent years are buying because they think it’s a great place to park their money. They spot high-quality items, things they think will go up in value,” Orlando said. “I think most collectors collect because they love it, and it just happens to have a financial component — but you don’t want to ignore the financial component.”

Of course, some collectors prefer to simply enjoy their collections. Edward Jastrem, chief planning office for Heritage Financial Services in Westwood, Massachusetts, said one client has a sizable collection of fine wine. “It was the kind of collection that would have brought money at auction, and when he retired, he started drinking the wine, opening the bottles at family events.”

Jastrem has seen clients bitterly disappointed when collections they thought were valuable turned out to be worth little or nothing.

“People think that because something is old, it must be worth something,” he said. “But just because it’s old or a famous name doesn’t mean there’s a market for it. Tastes change.”

For that reason, it’s important for clients to have realistic expectations.

“It’s dangerous to view collecting as the source of your wealth rather than an interest,” Jastrem said.

Storing or displaying a collection

Clients with collections should stay up to date on best practices for storage and display.

“What was once considered best practice for keeping a collection safe, clean and orderly can change,” Jastrem said.

Collectibles often require specialized care. Ruggie has his autographed baseball cards authenticated and protected by a transparent case. The Ali trunks have museum-quality framing.

“I keep some of my more valuable signed cards in a safe that’s in a fireproof room,” he said.

Jastrem collects toy soldiers in a lighted display cabinet. The original boxes take up more room than the soldiers. “I have a huge portion of our storage space filled with plastic tubs containing boxes,” he said. Boxes can boost value, particularly if they are in perfect condition.

Raleigh, North Carolina-based physician Perico Arcedo has collected nearly 1,000 fragrances. He stores them in a cool, dark room to help preserve them. Dark conditions can also help preserve autographs, which are vulnerable to fading if exposed to light.

Linda Krasner runs Vintage Repairs in Queens, New York, where she sees antique and modern handbags with a variety of problems. “Moths are terrible. So is moisture. If you live near salt water, your bags can get a verdigris that needs to be removed,” she said. Pets are dangerous, too. “I’ve restored more than a dozen bags over the past several years that have been eaten by dogs or birds.”

Insuring what you have

Some collectors don’t insure their collections beyond the coverage offered by their homeowners policies. Denver-area planner David Seufer collects fountain pens and relies on his homeowners insurance.

“I don’t know if a burglar would know what to do with a fountain pen,” he said.

Ruggie insures his collection for a substantial percentage of its value, which he updates regularly by consulting appraisers and by using auctions as a price metric. Krasner also insures her own collections with a policy that automatically increases their replacement value, and she annually reviews the value with her insurance broker.

Make a succession plan

Most people don’t have a good succession plan for their collections. Ruggie said it’s clear that his children aren’t interested in keeping his collection, so he’s gone out of his way to categorize what he has and point his heirs toward auction houses where they might sell it.

Los Angeles collector Larry Farinholt, who collects Asian art, Persian rugs, porcelain figurines, paintings, brown furniture, decoy ducks and small bronzes, is relying on his girlfriend to deal with his collection when he’s gone. “I’ve made her promise not to stick them in storage or give them away. She’ll find them loving new homes, like you would with a dog.”

Clients and planners should avoid leaving heirs with the situation that Dale Tegman of San Francisco faced when his father died, leaving a 150-square-foot room filled from floor to ceiling with unorganized stamps and coins.

“We were flying blind,” Tegman said. “He provided no guidance for us and no wishes with regard to his collections.”

So Tegman got out the coin book and looked up every coin, determining which had value to collectors. The subsequent auction grossed between $60,000 and $70,000, but at the price of a lot of work.

“It took about six weeks, including a solid two weeks on the basement floor moving bags of money around, to get it all. My dad could have made this easier for us than he did.”

Ingrid Case