Collectors

Planning for value, complexity, and legacy by integrating meaningful collections into long-term family wealth.

Why Your Collection Needs Financial Attention

Your collection is a sizable financial asset. We treat it accordingly.

Dated or Nonexistent Valuations

Failure to regularly value collection causes a fundamental misunderstanding of its size.

Allocation and Goals Misaligned

Lack of financial consideration for collection may result in an allocation incongruent with objectives and risk tolerance.

Poor Timing

Inattention to valuations and market conditions leads to poorly timed purchase, sale, and gifting decisions.

Lack of Integration

Collection isn’t integrated into estate, philanthropic, and trust planning, creating vulnerability and confusion.

Inadequate Protection

Neglect of the collection’s financial status results in insufficient insurance or storage protocols.

Complex Tax Implications

Transactions involving your collection can trigger capital gains, estate, and other tax considerations that should be evaluated as part of a broader financial plan.

Destiny Collectibles Scorecard

Helping collectors understand their position across ten key criteria

The Collectibles Scorecard is a proprietary diagnostic developed by Destiny Family Office to help established collectors assess how their passion assets align within a comprehensive, long-term wealth strategy.

The Scorecard provides perspective across key dimensions including acquisition discipline, preservation and stewardship, documentation integrity, insurance alignment, valuation oversight, and intergenerational transfer planning.

As part of our onboarding process, we walk through these areas together, illustrating what an optimally aligned collection typically reflects. This establishes a clear baseline and supports thoughtful integration within the broader family office framework.

Partner with an advisor who understands

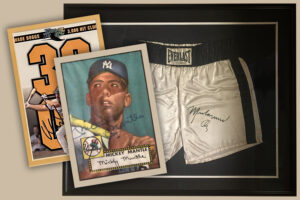

Our firm was founded and is led by a lifelong collector, a perspective that meaningfully shapes how we serve clients.

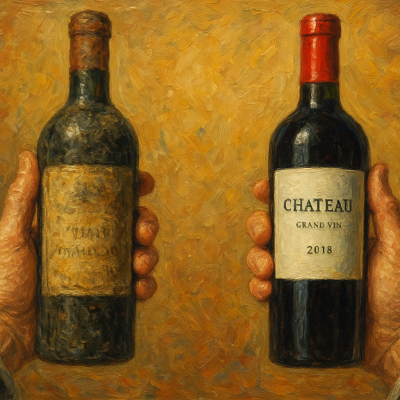

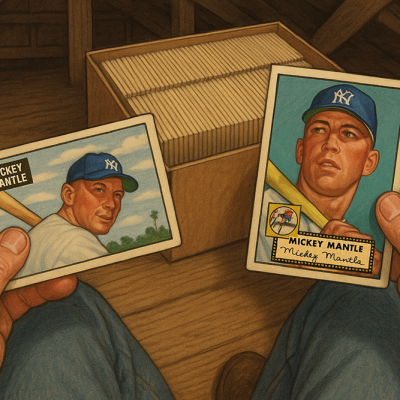

Tom Ruggie, ChFC®, CFP®, began collecting autographs as a boy outside Spring Training dugouts in Florida and has since built what PSA calls “one of the most impressive autographed baseball card collections in the hobby,” alongside significant sports memorabilia, wine, and pop culture collections. He approaches collectible wealth with deep respect for the passion behind it, helping families thoughtfully integrate these holdings into long-term financial planning, investment strategy, and estate considerations without reducing them to line items or isolated “alternative assets.”

Questions Collectors Ask About Working With Us

Who does Destiny Family Office work with?

Destiny Family Office works with high-net-worth individuals and families, helping wealth creators and inheritors navigate the complexity that comes with wealth planning. As part of those efforts, we work with clients who have assembled large collections which have evolved into valuable financial assets. Those collections generally represent a portion of client wealth, rather than serving as the primary vehicle for wealth creation, adding an additional layer of complexity in the planning process.

When should I get in touch with Destiny Family Office for help with my collection?

If you’ve built a significant balance sheet that includes a collection of material size, and you’ve found yourself struggling to properly integrate that collection into your broader financial planning and wealth strategy, then Destiny Family Office can assist. If your collection has grown to represent a material portion of your net worth, and your consultation with our Collectibles Scorecard reveals that you’re less organized than you’d like to be, please contact us today to learn more about how we can help you.

What services does Destiny Family Office provide to collectors?

Destiny Family Office integrates our clients’ valuable collections into our full suite of family office services, considering them in the context of their other assets.

- Financial Planning Including Your Collection. You know your collection better than anyone, but solitary knowledge can be a burden and a risk. Much like an air traffic controller, we work with your other trusted advisors who assist you with documentation, valuation, protection, and more, to help ensure they are all working as an integrated team on your behalf.

- Balance Sheet Integration. Your collection shouldn’t be isolated from the rest of your investments. Destiny Family Office will understand the size of your allocation to these valuable assets and evaluate it in the context of your portfolio to ensure alignment with your financial goals and risk tolerance.

- Estate & Succession Planning for Collectors. Some heirs are enamored with a collection’s contents. Others respect the passion but don’t share the interest. Whatever your situation, Destiny Family Office can assist with estate and succession planning that considers family dynamics and generates productive outcomes for your collection.

Will Destiny Family Office authenticate my items or help me submit my items for authentication?

Destiny Family Office is not an authenticator of memorabilia, and we do not accept submissions of memorabilia from collectors seeking authentication. We do, however, consult with onboarded Family Office clients to assist them with determining what items require authentication and which authentication service providers are best positioned to assist.

Can Destiny Family Office help me determine if there’s anything valuable in my collection?

Destiny Family Office is not an appraiser of collectibles, and we will not opine on inquiries from collectors seeking the estimated value of their collectibles. Our clients are generally aware of their collection’s approximate value and the items within the collection that are most valuable, and we facilitate formal appraisals and other services on their behalf.

Can Destiny Family Office sell my items for me?

Destiny Family Office is not an auction house or a marketplace for collectibles, nor do we purchase items directly from collectors. However, we do work with Family Office clients to help them determine the most appropriate strategies and venues for selling items, all as part of a broader suite of services managing client wealth.

Collector to Collector

Partner with an advisor who understands

Our firm was founded and is led by a lifelong collector, and that perspective informs how we work.

Tom Ruggie, ChFC®, CFP® started collecting autographs as a boy outside the dugouts during Spring Training in Florida. Tom has now amassed what PSA calls, “One of the most impressive autographed baseball card collections in the hobby.” And that’s only a small part of his overall sports memorabilia collection. This passion for collecting also extends to significant wine and pop culture collections.

Tom approaches collectible wealth with respect for the passion behind it, while helping families thoughtfully integrate these holdings into long-term financial planning, investment strategy, and estate considerations, without reducing them to line items or treating them as isolated “alternative assets.”

Questions Collectors Ask About Working With Us

Who does Destiny Family Office work with?

Destiny Family Office works with high-net-worth individuals and families, helping wealth creators and inheritors navigate the complexity that comes with wealth planning. As part of those efforts, we work with clients who have assembled large collections which have evolved into valuable financial assets. Those collections generally represent a portion of client wealth, rather than serving as the primary vehicle for wealth creation, adding an additional layer of complexity in the planning process.

When should I get in touch with Destiny Family Office for help with my collection?

If you’ve built a significant balance sheet that includes a collection of material size, and you’ve found yourself struggling to properly integrate that collection into your broader financial planning and wealth strategy, then Destiny Family Office can assist. If your collection has grown to represent a material portion of your net worth, and your consultation with our Collectibles Scorecard reveals that you’re less organized than you’d like to be, please contact us today to learn more about how we can help you.

What services does Destiny Family Office provide to collectors?

Destiny Family Office integrates our clients’ valuable collections into our full suite of family office services, considering them in the context of their other assets.

- Financial Planning Including Your Collection. You know your collection better than anyone, but solitary knowledge can be a burden and a risk. Much like an air traffic controller, we work with your other trusted advisors who assist you with documentation, valuation, protection, and more, to help ensure they are all working as an integrated team on your behalf.

- Balance Sheet Integration. Your collection shouldn’t be isolated from the rest of your investments. Destiny Family Office will understand the size of your allocation to these valuable assets and evaluate it in the context of your portfolio to ensure alignment with your financial goals and risk tolerance.

- Estate & Succession Planning for Collectors. Some heirs are enamored with a collection’s contents. Others respect the passion but don’t share the interest. Whatever your situation, Destiny Family Office can assist with estate and succession planning that considers family dynamics and generates productive outcomes for your collection.

Will Destiny Family Office authenticate my items or help me submit my items for authentication?

Destiny Family Office is not an authenticator of memorabilia, and we do not accept submissions of memorabilia from collectors seeking authentication. We do, however, consult with onboarded Family Office clients to assist them with determining what items require authentication and which authentication service providers are best positioned to assist.

Can Destiny Family Office help me determine if there’s anything valuable in my collection?

Destiny Family Office is not an appraiser of collectibles, and we will not opine on inquiries from collectors seeking the estimated value of their collectibles. Our clients are generally aware of their collection’s approximate value and the items within the collection that are most valuable, and we facilitate formal appraisals and other services on their behalf.

Can Destiny Family Office sell my items for me?

Destiny Family Office is not an auction house or a marketplace for collectibles, nor do we purchase items directly from collectors. However, we do work with Family Office clients to help them determine the most appropriate strategies and venues for selling items, all as part of a broader suite of services managing client wealth.

Collectible Conversations

Articles & Blog

Important conversations with experts and industry leaders in the family office space

How family offices can protect collectibles before hurricanes strike

By Andrew Cohen,

Crain Currency,

Oct. 15, 2024

Four Things to Know About Your Collectibles and Homeowners Insurance

by Tom Ruggie,

Published by Kiplinger

October 3, 2024

Why a $24.1 million Babe Ruth jersey may seem like a bargain in the years ahead

By Charles Passy,

MarketWatch,

Aug. 27, 2024

It’s an ultra-wealthy dilemma: Who inherits the wine and art collections?

By Beth Pinsker, MarketWatch, Aug. 31, 2024

It’s Not Just Stuff: Ten Insider Tips For Managing Specialty Collections

By Tom Ruggie,

Published on Forbes.com,

June 5, 2024

Sports Memorabilia Arrive as an Investing Class

By Tom Ruggie

Published in Kiplinger

June 14, 2024

Your heir doesn’t want to keep your collection. Now what?

By Andrew Cohen,

Published in Crain Currency,

May 23, 2024

From Acquisition to Sale: Making the Most of Your Collectibles

By Margaret Steen,

FO Pro,

May 6, 2024,

The Met Opera May Sell Its Iconic Paintings. Is it a Good Investment?

Published on Kiplinger.com

January 28, 2026

What are the pros and cons of borrowing against art, watches, and other collections?

With the growing availability of lending options and varieties, collectors should understand and evaluate the various benefits and risks of borrowing using their collections as collateral.

What are the most expensive guns ever sold at auction?

For collectors, setting a target in your sights takes on a new meaning when talking about antique firearms. We’ve chronicled each firearm known to have sold for over $1,000,000 at ...

How much is my Mickey Mantle rookie card worth?

Mickey Mantle spawned many a youth’s obsession with baseball card collecting.

How much is my Wayne Gretzky rookie card worth?

For hockey card collectors, no card carries the cachet of a Wayne Gretzky rookie card.

What financial matters should collectors consider when selling art, memorabilia, or other collectibles?

That multimillion-dollar memorabilia sale you saw in the headlines? The seller likely walked away with far less than the hammer price suggests.

Behind every record-breaking sale is a series of ...

Tom Ruggie on Collectibles

Video & Podcast Content

Playlist

18:23

3:22

38:56

32:24

50:43

41:01

4:54

1:07