Estate planning

Successfully managing risks and opportunities has allowed you to build your family's wealth, but what happens when you're no longer able to make financial decisions in your best interests? For affluent families, these questions often require complex and dynamic answers.

Comprehensive estate planning provides peace of mind with a customized strategy that addresses your current financial situation and adaptable to future changes.

About Our Estate Planning Family Office Services

At Destiny Family Office, we cater to the needs of ultra-high-net-worth individuals, including successful entrepreneurs, high-end collectors, and other wealth creators whose estates require individualized planning approaches.

Our collaboration and insights assist in developing strategies aimed at protecting and preserving accumulated wealth while facilitating a smooth transition to future family generations and other beneficiaries.

Our estate planning services include:

- Charitable estate planning: Many UHNW people are passionate about supporting causes that align with their values. If doing so is important to you, effective planning can help enhance the impact of your philanthropy. We work with your other trusted advisors to integrate your charitable goals into your overall tax planning and optimization strategy.

- Posthumous: The transfer of wealth to the next generation is a primary concern for affluent families. We collaborate with your other trusted advisors to implement your distribution strategy and support smooth asset transitions for your heirs.

Estate Tax Exemption Planning

The Tax Cuts and Job Acts (TCJA) of 2017 represented a significant overhaul of the federal tax code since 1986. While the law maintained the tax structure of seven individual income brackets, it lowered the rates in several others, providing substantial tax relief for many Americans.

The TCJA is not permanent — its provisions are due to sunset at the end of 2025. When this occurs, the current estate tax exemption of $12 million will decrease to $7 million per person. Consequently, if an individual’s net worth exceeds or is projected to exceed the exemption amount, the excess may be subject to a tax rate of up to 40% upon death of the first or second spouse.

Understandably, this impending change is a cause for concern for many ultra-high-net-worth individuals. Effective estate tax exemption planning is essential to minimizing tax impact and safeguard wealth. A thorough analysis and robust estate plan can help protect the assets you’ve worked so hard to attain, ensuring they are preserved for future generations and charitable endeavors.

Learn More About Family Office Estate Planning

The team at Destiny Family Office is ready to assist you fulfill your highest destiny with bespoke estate planning tailored to your goals and concerns. Call us to discuss your goals, concerns, and desires. You can also contact us by submitting our online contact form today.

First Things First

Complete Your Destiny Scorecard

Completing your Scorecard takes only minutes, but the insights you will gain into your situation may well be profound.

Protection of Family Wealth

Estate Services, Decision-Making, Legal,

Tax Planning, Insurance, Legacy and Longevity planning

Family Leadership & Succession Planning

Life Management, Communication, Budgeting, Business and Family Next-Generational Planning, Transitions

Management of Family Assets

Investment Management, Private Equity, Reporting, Corporate Finance and Services

Entrepreneurship Guidance

Tailored advice to help you navigate the opportunities and obstacles facing your business and achieve success.

Protection of Family Wealth

Family Leadership & Succession Planning

Management of Family Assets

Entrepreneurship Guidance

Creating a Legacy of Continual Innovation

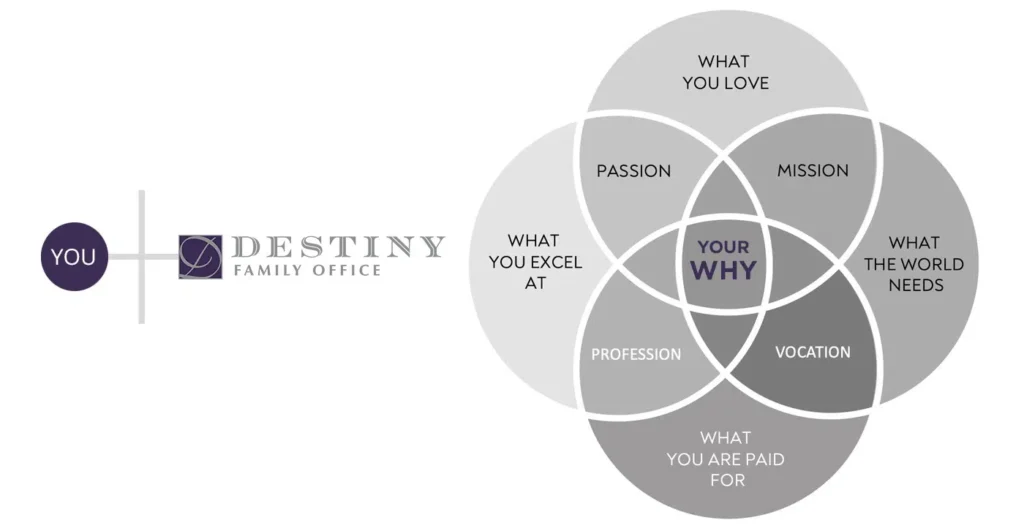

We’ve addressed what we see as an unanswered need in the investment and wealth management ecosystem for deep strategic thinking in key areas tailored to your situation, needs and goals. As a result, you are better able to navigate the complexity that exists at the intersection of your human, intellectual and financial capital.

Goldman Sachs Relationship Expands Capabilities

Destiny Family Office’s primary custodial relationship with Goldman Sachs Advisors Solutions reflects our focus on the consistent delivery of an exceptional client experience – one which provides access to uncommon expertise in areas such as lending and investment banking – capabilities that complement our own.

Principles We Live By

▸ Make Excellence a Prerequisite

▸ Be a Formidable Competitor

▸ Seize Opportunities

▸ Go Beyond Technical Knowledge

▸ Challenge Convention

▸ Act with Moral Courage

▸ Lead Quietly

▸ Simplify Lives